Retirement for dummies/Retirement 101

As we go through life, our needs evolve.

Find out more about our Personal Insurance Services.

Share this article

Written by: Zichun, Rane, Sharonne and Jiafu Mentor by: Phua Jia Yi (Senior Financial Consultant, RNF No: PJY300081092) What is retirement? Society is now met with this concept of “living for too long”. What does…

Written by: Zichun, Rane, Sharonne and Jiafu

Mentor by: Phua Jia Yi (Senior Financial Consultant, RNF No: PJY300081092)

What is retirement?

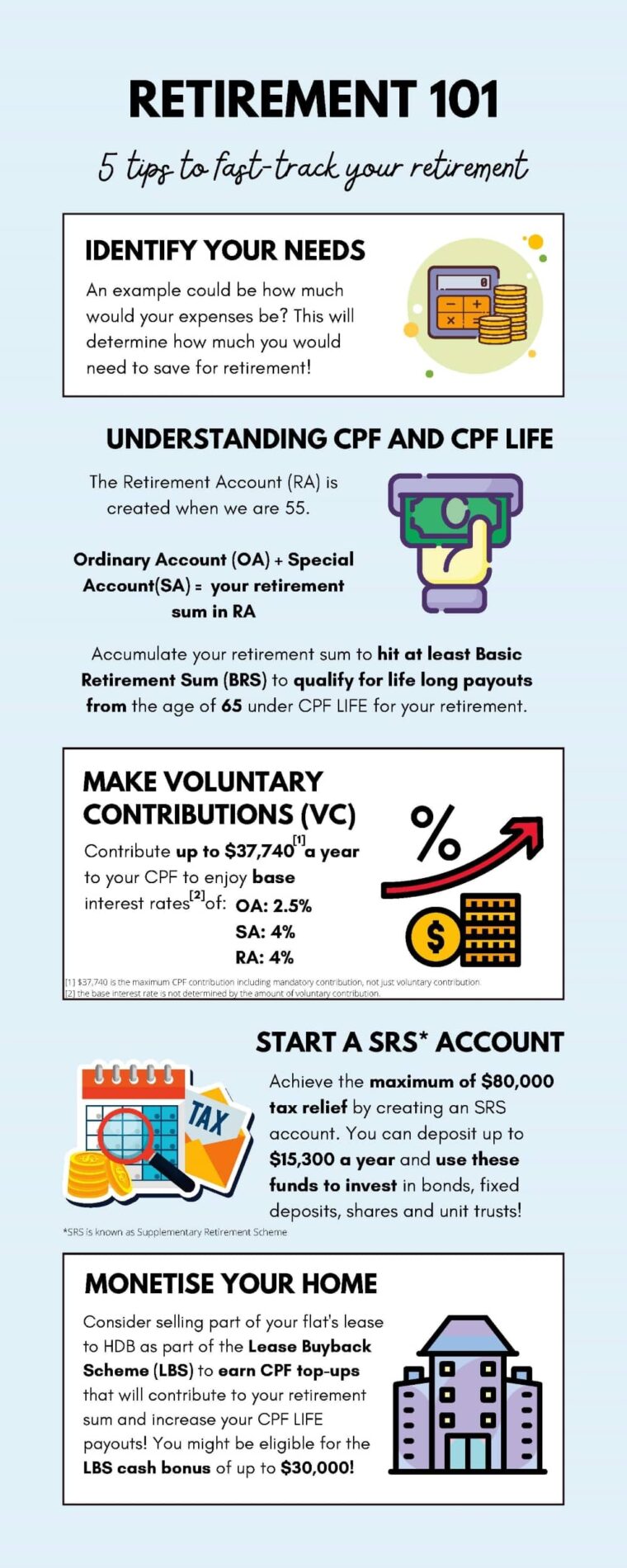

Society is now met with this concept of “living for too long”. What does that mean for us? According to the Ministry of Manpower (MOM), it is stated in the Retirement and Re-employment Act (RRA), the minimum retirement age is now 63 years old. Additionally, the average age expectancy has been steadily increasing over the years in Singapore. Males at 81.1 and females at 85.9 (DOS, 2022). This implies that on average, we will live for about 20 years after we retire! Then consider how are you going to generate funds for your expenses? This is retirement planning.

What is your definition of retirement?

The age that you would like to retire could be different from your peers. Everybody has different needs and expectations; managing them are crucial to a realistic retirement plan.

All these factors affect how much you have to save right now. Great Eastern offers a useful tool that can estimate how much money you need for retirement given your desired lifestyle1.

Understanding your CPF

The Central Provident Fund (CPF) is a starting point for many Singaporeans or PRs for retirement planning. CPF is a compulsory savings account by the Singapore government for all Singaporeans with the main purpose of setting aside retirement funds.

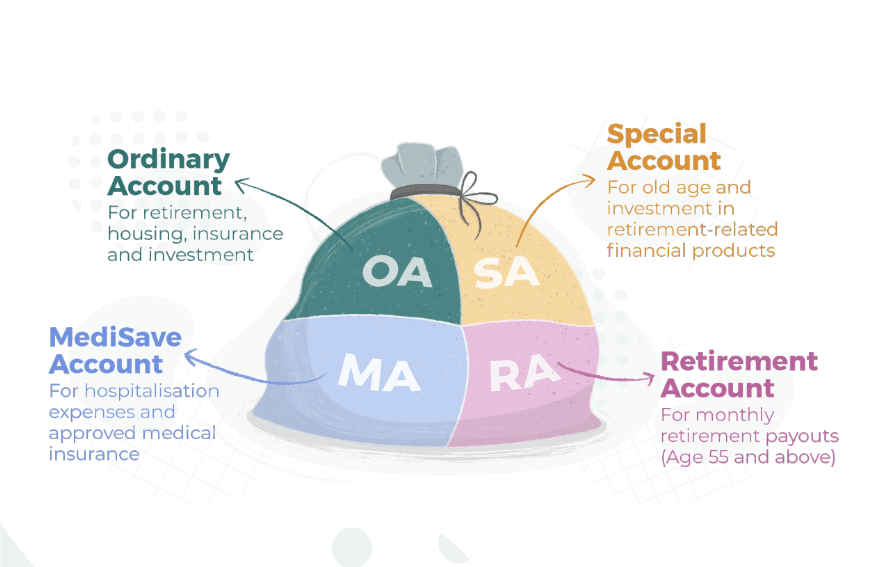

CPF is made up of four accounts; Ordinary Account (OA), Special Account (SA) and your Medisave Account (MA). The Retirement Account (RA) is created when we are 55. It combines the savings of our OA and SA to form our retirement sum up to Full Retirement Sum (FRS) (CPFB, 2022).

What is CPF LIFE?

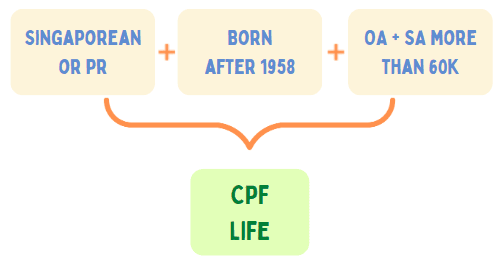

If you are a Singaporean or PR, born after 1958 with a combined OA and SA sum of at least SGD60k, you will be automatically enrolled into this scheme called, CPF Lifelong Income for Elderly (CPF LIFE).

CPF LIFE allows you to get lifelong retirement pay outs from age 65 based on the amount you have accumulated in your retirement sum. You have the option to defer your pay outs anytime from age 65 to 70 if you do not need the pay outs yet. By doing this, you can earn 4% more interest each year on your retirement sum in your RA!

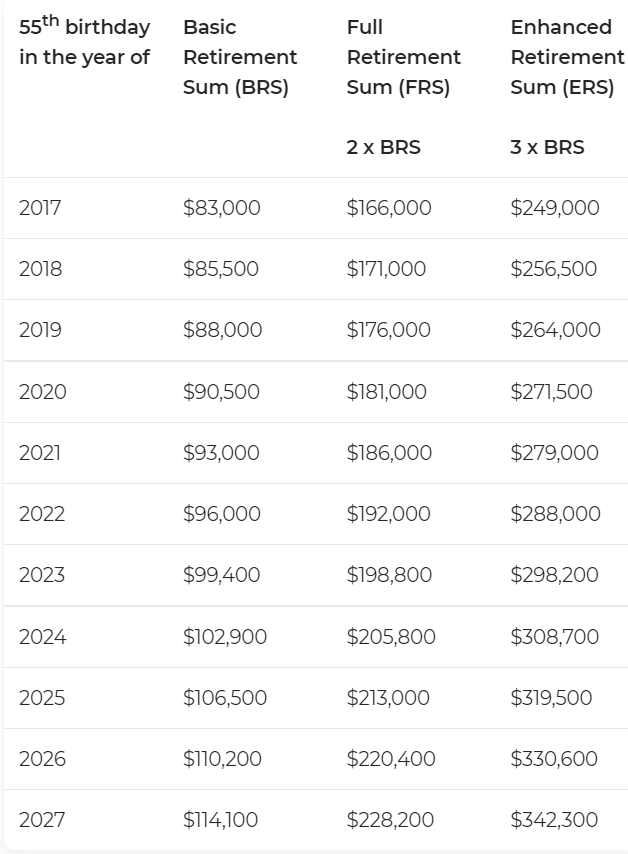

The table above shows the total retirement sum you would need to hit Basic Retirement Sum (BRS), Full Retirement Sum (FRS), and Enhanced Retirement Sum (ERS). These numbers increase each year to account for inflation. At the age of 55, you would be able to withdraw from your CPF but you might want to consider how this would affect your retirement sum and consequently your CPF LIFE monthly pay outs in the future!

What if you do not hit BRS?

It is okay if you have less than BRS in your RA so do not worry! Your monthly CPF LIFE pay outs will just be based on your accumulated sum in your RA and pay outs will last until your RA savings run out (CFPB, 2022).

How to build your retirement sum ASAP

1. Are you making voluntary contributions to your OA and SA before 55?

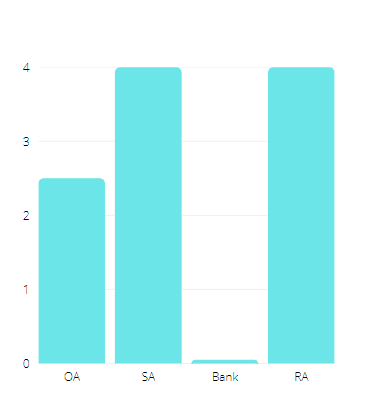

Did you know that your OA and SA have base interest rates of 2.5% and 4% per annum respectively? This is much higher compared to leaving your money in a bank that generates 0.05% per annum (CFPB, 2022).

You can top up a maximum of SGD37,740 including the mandatory contribution per annum to your SA to enjoy up to your SGD8,000 tax relief. Additionally, you can transfer funds from your OA to SA and you will earn an additional 1.5% interest rate!

2. Do you have a Supplementary Retirement Scheme (SRS) account?

SRS complements the CPF and is part of the Singapore government’s strategy to aid in the retirement of Singaporeans and PRs. Unlike the CPF scheme, participation in SRS is voluntary. SRS members can deposit up to SGD15,300 in a year to enjoy personal tax relief of up to SGD80,000 per annum. All Singaporean, PRs and even foreigners who are at least 18 years old; not undischarged bankrupts; not mentally disordered and are capable of managing themselves and their affairs can create an SRS account at DBS, OCBC or UOB bank. Since SRS account only generates a fixed interest rate of 0.05%, you can use these funds to do investment to maximise potential gains. Depending on your risk profile, there are various government approved investment products that you can invest in, such as bonds, fixed deposits, shares and unit trust. Investment returns are accumulated tax-free and only 50% of the withdrawals from SRS are taxable at retirement. You can refer to IRAS’ website for more information on how withdrawals will be taxed. It is also important to note that SRS is only essential if you have maxed out your tax relief of SGD80,000 (IRAS, 2022).

3. Consider monetising your home

Besides renting out a room or two, you can opt for the Lease Buyback Scheme (LBS) which allows you to sell part of your flat’s lease to HDB and earn CPF top-ups. This top-up can be used to contribute to your RA which also increase your CPF LIFE monthly payouts! Additionally, you might be eligible for an LBS cash bonus of up to SGD30,000 depending on your flat size and the amount of CPF RA top-up (DollarsAndSense, 2022).

Conclusion

Most people would want to live a comfortable lifestyle after retirement, and according to the retirement calculator2 someone who wants to retire with a comfortable lifestyle, would require an average monthly pay out of SGD2,900 today. This is more than the monthly pay out of CPF LIFE even at ERS. Therefore, you may wish to supplement your retirement income using various available retirement income insurance policies!

Sources

CPFB. (2022, June 15). CPFB: CPF Overview. Central Provident Fund Board (CPFB). Retrieved July 4, 2022, from https://www.cpf.gov.sg/member/cpf-overview

CPFB. (2022, March 28). CPFB: What are the retirement sums applicable to me?

Central Provident Fund Board (CPFB). Retrieved July 4, 2022, from

https://www.cpf.gov.sg/member/faq/retirement-income/general-information-on-retirement/what-are-the-retirement-sums-applicable-to-me-

CPFB. (2022, June 2). CPFB: Monetising your home to boost your retirement income. Central Provident Fund Board (CPFB). Retrieved July 3, 2022, from https://www.cpf.gov.sg/member/infohub/educational-resources/monetising-your-home-to-boost-your-retirement-income

DOS. (2022, June 1). Life Expectancy by Sex. Tablebuilder.singstat.gov.sg. Retrieved July 1, 2022, from https://tablebuilder.singstat.gov.sg/table/TS/M810501

IRAS. (2022). IRAS: SRS Contributions and tax relief. Inland Revenue Authority of Singapore. Retrieved July 3, 2022, from https://www.iras.gov.sg/taxes/individual-income-tax/basics-of-individual-income-tax/special-tax-schemes/srs-contributions